Investment Portfolio

At RapidIT Venture Capital, we invest in innovative startups across a diverse range of industries, each with transformative potential. Our portfolio reflects a strategic blend of investments that leverage AI, automation, and technology to shape the future.

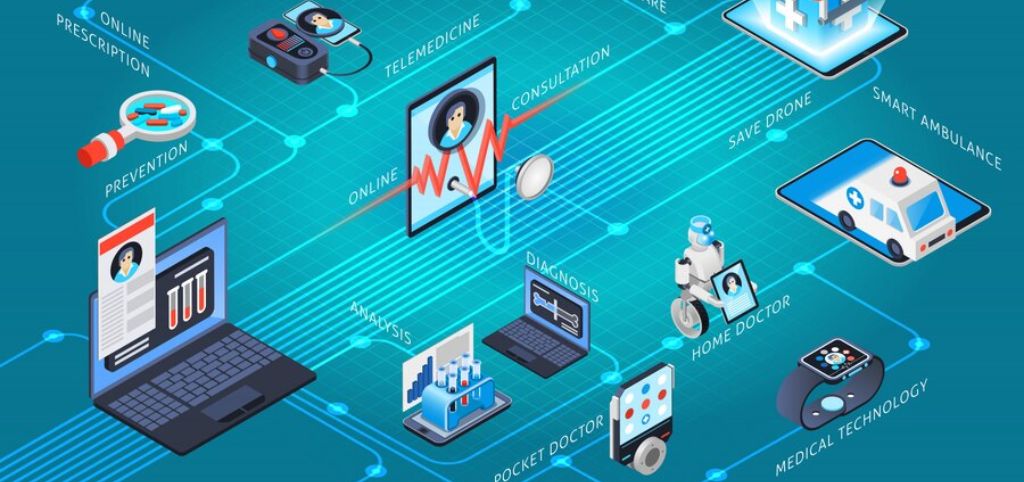

Healthcare Sector

Our healthcare investments focus on AI-driven solutions that enhance automation, accessibility, and wellness. We support companies that redefine healthcare delivery and consumer engagement.

- ViyaMD - Investment: $1M

- Wellnesys Inc. - Investment: $1.5M

ViyaMD

ViyaMD is revolutionizing healthcare through AI-powered automation. This solution optimizes healthcare workflows, making quality care more accessible and efficient. By leveraging advanced algorithms, ViyaMD reduces the administrative burden, allowing healthcare providers to focus more on patient care.

Wellnesys Inc. (Yogifi.fit)

Wellnesys Inc. brings innovation to the fitness industry with Yogifi.fit, a smart yoga mat and ring using AI to elevate the fitness experience. This product integrates personalized guidance and real-time feedback to help users improve their wellness through yoga, bridging technology and mindfulness.

EdTech Sector

Our investments in education technology (EdTech) emphasize accessibility, quality, and scalability in learning. We aim to support solutions that foster global educational reach and blend traditional and digital learning.

Turito Inc. (turito.com)

Turito Inc. is a global K12 education delivery platform offering both online and brick-and-mortar options. Focused on quality education, Turito combines modern learning techniques with a physical presence, creating a holistic educational experience for students around the world. The platform’s adaptability enables access to diverse curricula and skill-building, making it a leader in today’s EdTech landscape.

FinTech Sector

In FinTech, we prioritize platforms that use AI and data to transform financial services, from trading to mortgages. Our portfolio companies offer innovative solutions that enhance efficiency, accuracy, and accessibility in finance.

- TradersAI.com - Investment ($3M)

- Homeloc - Investment ($750K)

TradersAI.com

TradersAI.com is a cutting-edge AI-based futures trading platform that has recently launched an ETF (Ticker: HFSP). This platform empowers traders with advanced predictive analytics, allowing for more strategic decision-making in the market. With its AI-driven approach, TradersAI simplifies the complexities of futures trading, appealing to both seasoned and novice investors.

Homeloc Distributions (Home Rates Yard)

Homeloc Distributions revolutionizes the mortgage experience by creating a unified platform for lenders, brokers, and consumers. Known as Home Rates Yard, this platform streamlines the mortgage process, offering transparency and efficiency that improves the experience for all stakeholders involved. It allows users to make well-informed decisions in a simplified, consumer-friendly environment.

Dheyo AI Inc.

Dheyo AI Inc. offers a secure platform designed to run Large Language Model (LLM) applications while protecting confidential data. Dheyo.ai enables companies to leverage AI’s power without compromising on data security, addressing a crucial need in today’s data-driven world. Its commitment to privacy and performance makes it ideal for businesses handling sensitive information.

Impac Labs (impac.io)

Impac Labs specializes in automating cloud security policies to safeguard data across platforms. By reducing the manual work involved in managing cloud security, Impac.io enhances compliance and fortifies security in cloud environments. Their solutions help businesses maintain stringent data protections, aligning with regulatory standards and the evolving landscape of cybersecurity.

Technology Sector

Our technology investments focus on platforms that secure data, automate processes, and enhance productivity. By investing in next-gen tech companies, we support the development of tools that ensure data privacy and improve cloud-based operations.

- Dheyo AI Inc. - Investment ($1M)

- Impac Labs - Investment ($2M)

Frequently Asked Questions

Get answers to common questions about our investment process, support, and philosophy. Learn how RapidIT Venture Capital can help drive your startup’s success.

We focus on Pre-Seed and Seed-level investments in sectors where we can add strategic value, including Healthcare, EdTech, FinTech, and Sports & Entertainment.

Our initial investments generally range from $1M to $3M, depending on the startup’s potential and the stage of development.

We invest in early-stage startups that align with our values, helping them scale to $10M in annual revenue. Our approach combines capital, strategic guidance, and a focus on long-term partnerships.

Yes, we actively support our portfolio companies through advisory roles, industry insights, and strategic guidance to drive growth at every stage.

Startups can reach out to us through our contact page. Our team will review your proposal and follow up for additional information if there’s a potential fit.

While headquartered in Georgia, we are open to investing in innovative startups from around the world.

Our team’s unique blend of entrepreneurial and corporate experience allows us to provide tailored support beyond just capital. We are committed to helping startups succeed through hands-on involvement and strategic guidance.

What Client Say

Hear from the innovators and leaders we’ve supported on their journey. Discover how RapidIT Venture Capital has empowered our partners to achieve remarkable growth.

Our Commitment to Transformative Innovation

Each investment in our portfolio reflects RapidIT Venture Capital’s dedication to sectors where technology can create a lasting impact. From healthcare to FinTech, our partnerships with pioneering startups drive meaningful change in their industries, setting a foundation for growth and innovation.